United Housing Community Bonds

North Perth Housing Projects

Project Summary

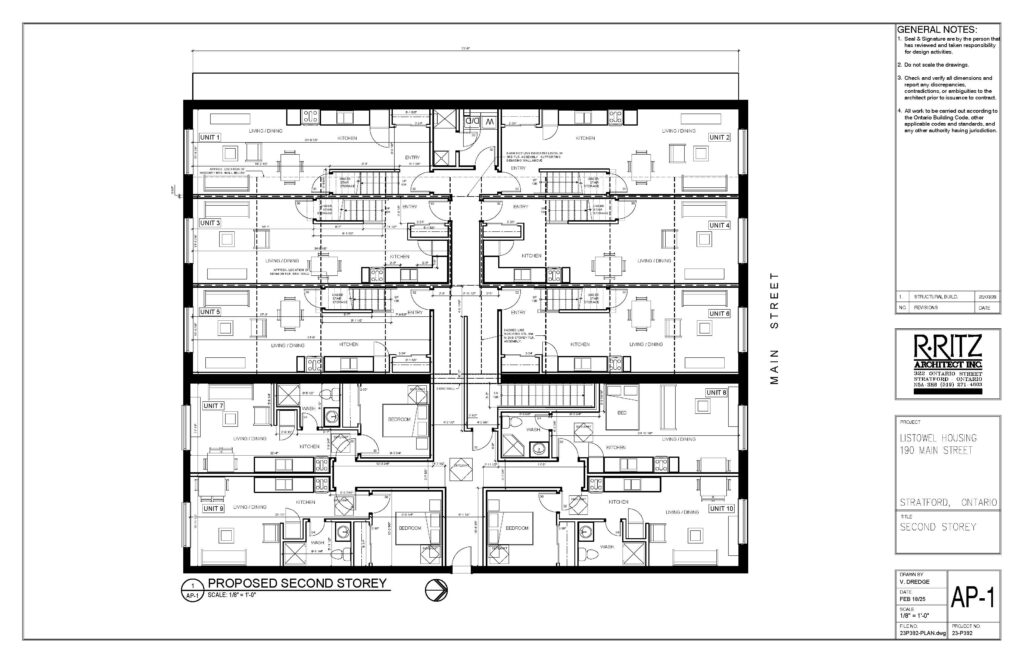

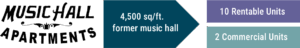

Become part of Listowel’s history at 190–198 Main Street West, a venerable building that was home to a dance hall from 1895 well into the 1970s. Now, this location is ready for its next chapter, and you can play a role in its transformation.

By investing in Community Bonds, you’ll help United Housing transform the building’s 4,500 square-foot second floor into 10 mixed-use rental units. This renovation—a reinvigoration of an historic part of the downtown—will provide 10 mixed-income rental units.

What if your investments could transform your community?

Put your money to good work! Join us in building mixed-income rentals.

Investment Options

Series A

MIN.

$25K

Seven –

year term

3.5%

ANNUAL INTEREST

Simple interest

paid at maturity

Series B

MIN.

$5K

Five –

year term

3%

ANNUAL INTEREST

Simple interest

paid annually

Series C

MIN.

$1K

Five –

year term

2.5%

ANNUAL INTEREST

Simple interest

paid annually

FAQ

What are the risks of purchasing a United Housing Community Bond?

As with any investment, bonds carry some risk. United Housing is financially stable and in good standing with funding partners. Investors are encouraged to review the investor package (available upon request), detailing the offering and United Housing finances, before investing.

What happens when my bond matures?

Principal dollar amounts will be held for the term of the bond (three to seven years). Upon maturity, investors are entitled to have their bond principal returned and may also be offered an opportunity to re-invest the principal for a new term.

Are there investment limits for United Housing Community Bonds?

Bonds are available from $1K–$25K, with no maximum investment until the $735K campaign goal is met.

Who is eligible to invest?

Our community bond is open to investment from all types of investors including non-accredited / accredited individuals, corporations and institutions. There is a residency requirement for individual investors as these individuals need to be Canadian citizens or have permanent residency status. All investors have to bank with a Canadian financial institution.

Who is managing the investment process?

United Housing is managing the investment process internally with guidance by Tapestry Capital.

Questions? Contact us at bonds@unitedhousingperthhuron.ca or Toll Free: 877-818-8867

TFSA and RRSP Eligibility

United Way Perth-Huron has commissioned an independent legal opinion that United Housing Bonds are qualified investments to be held in registered accounts under Regulation 4900(1)(j) of the Income Tax Act. However, it is up to the discretion of each institution to hold Community Bonds in a registered account on your behalf, and investors often find their financial institution will not allow them to include privately issued securities such as these in their registered accounts. More details about this option are included below under, ‘Community Bonds in a Self-Directed RRSP and/or TFSA.’

To assist investors in holding their United Housing Bonds in registered plans, United Way Perth-Huron has developed a partnership with the Canadian Worker Co-op Federation (CWCF)’s Common Good Capital Program, whereby Series A & B United Housing Bonds can be held there in RRSPs and TFSAs. You can open an account with CWCF, transfer funds from an existing RRSP or TFSA, or make a new contribution.

The Canadian Worker Co-op Federation (CWCF) will hold United Housing Bonds on your behalf in an RRSP and/or TFSA account with Concentra/Wyth Financial as a trust agent. CWCF charges $65 per year to administer the account, and you may only hold securities offered by co-operatives and not-for-profits in that account. Be sure to invest an amount that makes sense based on the interest you will earn after paying the fees.

RRSP CASH TRANSFER–IN

Set up an RRSP Account with CWCF and transfer in funds from an RRSP at another brokerage/financial institution.

RRSP CASH CONTRIBUTION

Set up an RRSP Account with CWCF and make a new contribution.

TFSA CASH TRANSFER

Set up a TFSA Account with CWCF and transfer in funds from a TFSA at another brokerage/financial institution.

TFSA CASH CONTRIBUTION

Set up a TFSA Account with CWCF and make a new contribution.

Fees to hold United Housing Bonds in an RRSP and/or TFSA at Common Good Capital

- CWCF charges an annual account holder fee of $65.

- CWCF charges a one-time transfer-in fee for bonds purchased via transferred-in funds from another RRSP & TFSA.

United Way Perth-Huron will collect all fees for the five and seven years of the Series A and B investments up front via pre-authorized debit.

Community Bonds in a Self-Directed RRSP and/or TFSA

You can inquire with your wealth manager or investment advisor about holding your Community Bonds in your self-directed RRSP and/or TFSA at your brokerage/financial institution. Please note it is up to your advisor and the institution’s compliance department to approve an investment in Community Bonds, and you may experience challenges in this regard. The institution will also set any fees or criteria for investing, and you must confirm this information with them. Please contact us at UH@perthhuron.unitedway.ca if you’d like to work with your financial institution to hold your United Housing Bonds in your self-directed RRSP and/or TFSA.

About the Canadian Worker Co-op Federation

The Canadian Worker Co-operative Federation (CWCF) is a national, grassroots membership organization of and for worker co-operatives, related types of co-operatives (multi-stakeholder co-ops and worker-shareholder co-ops), and organizations that support the growth and development of worker co-operatives. They have created a program called Common Good Capital whereby securities issued by non-profits and co-ops can be held in RRSPs and TFSAs.

About Common Good Capital

The CWCF is registered with the Canada Revenue Agency to manage self-directed RRSP and TFSA accounts through Concentra/Wyth Financial as a trust agent. Open a self-directed account to hold Community Bonds by making new contributions or transferring RRSP or TFSA funds from other institutions. There is no RESP or RRIF program available so please ensure you are of the age that you can hold this bond in an RRSP for at least 5 years (i.e., not over 66).

Once your account is set up, you can contact the CWCF directly to make changes to your account or to make a withdrawal:

Josh Dyke,

RRSP Program Administrator

josh@canadianworker.coop

902-678-1683